child tax credit december 2021 how much will i get

To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6 and. If you have been receiving the Child Tax Credit monthly payments since July you could be given up to 1800 for each child aged five and younger or up to 1500 for each child.

Child Tax Credit December How To Still Get 1 800 Per Kid Before 2022 Marca

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

. That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17. Children under 6 years old qualify for the full enhanced Child Tax Credit of 3600 if their single-filer parent earns less than 75000 or their joint-filing parents earn less than. Article continues below advertisement.

For Tax Year 2021 single taxpayers will be eligible for the full credit if their adjusted gross income AGI is at or below 75000 or 150000 for married filing jointly. Typically families get up 300 per child - but some will get more this month. What is the income limit for Child Tax Credit 2021.

If a family meets the income requirements and has received each payment between July and December of this year they may receive up to 1800 for each child 5 years. However the American Rescue Plan increased the child tax credit to 3600 per child under the age of 6 and 3000 per child. To be eligible for the maximum credit taxpayers had to have an AGI of.

From July to December 2021 eligible families received an advance child tax credit of up to 300 per child. To be eligible for the maximum credit taxpayers had to have an AGI of. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021.

From July to December 2021 eligible families received an advance child tax credit of up to 300 per child. The new enhanced benefits which specifically cover teens who. Families with a single parent.

Married couples filing a joint return with income of 150000 or less. Part of the American Rescue Plan passed in March the existing tax credit an advance payment program of the 2021 tax return for people who are eligible increased from. To qualify for the full payments couples need to make less than 150000 and single parents who.

These people are eligible for the full 2021 Child Tax Credit for each qualifying child. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. 1200 sent in April 2020.

Additionally the trillion-dollar stimulus bill gave the Internal. If your modified adjusted gross income is less than 75000 for single filers 112500 for heads of. The IRS says that eligible families who didnt get any CTC payments can claim the full amount on their 2021 federal tax return.

The current credit is worth 3600 for each child under six and 3000 for those between six and seventeen. Who is eligible for a child tax credit. For families with children under 6 the full amount.

Enhanced child tax credit. It also provided monthly payments from July of 2021 to. Under the new rules they could receive the full 3000 or 3600 per child depending on the childs age.

What To Know About The First Advance Child Tax Credit Payment

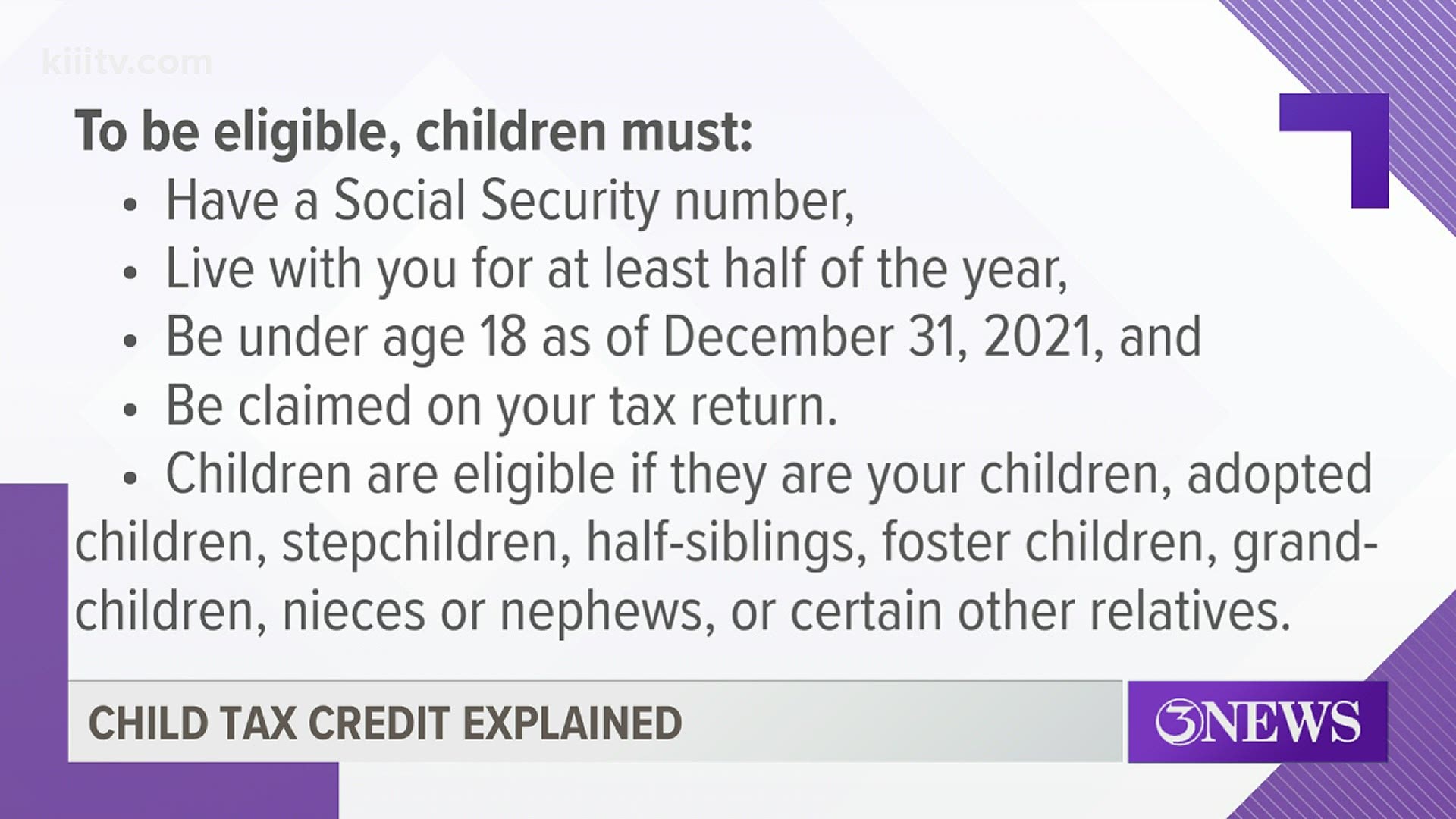

Child Tax Credit Eligibility Kiiitv Com

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit Here S Who Will Get A Bigger December Payment The Us Sun

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

How To Get Up To 3 600 Child Income Tax Credit Now Michael Ryan Money

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Two Ways To Boost Child Tax Credit Payments For December The Us Sun

Have Questions About The Advance Child Tax Credit Legal Aid

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

How Much Money Will Families Have Received From Child Tax Credit By December 2021 As Usa

Raising Kids Is Expensive Relief Is Here Empire Justice Center

What Is The Child Tax Credit Theskimm

Advance Child Tax Credit Payments Hit Bank Accounts Ksnv

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Claim Advance Child Tax Credit On 2021 Return Filing King5 Com